- Quick guide -

Save a card

Save card details for future transactions.

This feature is only available if you subscribed to the Pro offer.

Which programming language do you prefer?

| PHP

| Python

|

Use arrow keys or space bar to navigate in the presentation.

Authentication

Verify your identity when communicating with the API by providing a secret key in all your requests.

To submit your credentials, include your key in all pages that use the API:

<?php

\Payplug\Payplug::init(array(

'secretKey' => 'sk_live_YOUR_PRIVATE_KEY',

'apiVersion' => 'THE_API_VERSION',

));

payplug.set_secret_key('sk_live_YOUR_PRIVATE_KEY')

API keys start with “sk_”.

They are available in My account, then API Credentials in the PayPlug portal.

Access LIVE and TEST modes using the same endpoint. To switch between modes, simply provide the related secret key to the mode you wish to access.

Take a look at the changelog to know which api version you should use.

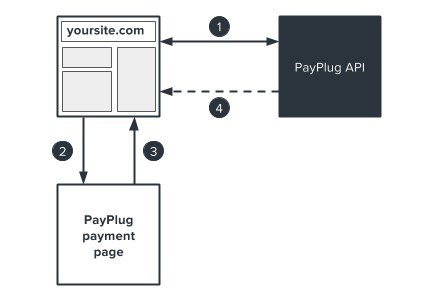

Using the “save card” feature

- Create the payment using

save_card = true; a link to a payment page will be generated.

- Redirect the customer to the payment page.

- After entering card details, your customer is automatically redirected to the previously-indicated return page on your site.

- PayPlug sends you a confirmation including the secure card ID via IPN (Instant Payment Notification).

Combining the “save card” with a payment

The following is an example of a payment with the “save card” feature that automatically redirects your client to the payment page:

<?php

$email = 'john.watson@example.net';

$amount = 33;

$customer_id = '42710';

$payment = \Payplug\Payment::create(array(

'amount' => $amount * 100,

'currency' => 'EUR',

'save_card' => true,

'billing' => array(

'title' => 'mr',

'first_name' => 'John',

'last_name' => 'Watson',

'email' => $email,

'address1' => '221B Baker Street',

'postcode' => 'NW16XE',

'city' => 'London',

'country' => 'GB',

'language' => 'en'

),

'shipping' => array(

'title' => 'mr',

'first_name' => 'John',

'last_name' => 'Watson',

'email' => $email,

'address1' => '221B Baker Street',

'postcode' => 'NW16XE',

'city' => 'London',

'country' => 'GB',

'language' => 'en',

'delivery_type' => 'BILLING'

),

'hosted_payment' => array(

'return_url' => 'https://example.net/success?id='.$customer_id,

'cancel_url' => 'https://example.net/cancel?id='.$customer_id

),

'notification_url' => 'https://example.net/notifications?id='.$customer_id,

'metadata' => array(

'customer_id' => $customer_id

)

));

payment_data = {

'amount': 3300,

'currency': 'EUR',

'save_card': True,

'customer': {

'email': 'john.watson@example.net'

},

'hosted_payment': {

'return_url': 'https://example.net/success?id=42710',

'cancel_url': 'https://example.net/cancel?id=42710',

},

'notification_url': 'https://example.net/notifications?id=42710',

'metadata': {

'customer_id': 42710,

},

}

payment = payplug.Payment.create(**payment_data)

All amounts must be expressed in centimes as positive whole numbers (1€ = 100 centimes).

Confirmation

When creating a payment, you can specify a notification URL for use with IPN: notification_url. Whether the payment is successful or fails, a POST query containing an object corresponding to the payment will be sent to your server.

<?php

$input = file_get_contents('php://input');

try {

$resource = \Payplug\Notification::treat($input);

if ($resource instanceof \Payplug\Resource\Payment && $resource->is_paid) {

$payment_id = $resource->id;

$payment_state = $resource->is_paid,true;

$payment_date = $resource->hosted_payment->paid_at;

$payment_amount = $resource->amount;

if ($resource->save_card == true) {

$card_id = $resource->card->id;

$card_exp_month = $resource->card->exp_month;

$card_exp_year = $resource->card->exp_year;

}

$payment_data = $resource->metadata[customer_id];

}

}

catch (\Payplug\Exception\PayplugException $exception) {

echo htmlentities($exception);

}

request_body = request.body

try:

resource = payplug.notifications.treat(request_body)

except payplug.exceptions.PayplugError:

pass

else:

if resource.object == 'payment' and resource.is_paid:

payment_id = str(resource.id)

payment_state = str(resource.is_paid)

payment_date = datetime.datetime.fromtimestamp(resource.hosted_payment.paid_at).strftime('%d/%m/%Y %H:%M:%S')

payment_amount = str(resource.amount)

if resource.save_card == True

card_id = str(resource.card.id)

card_exp_month = str(resource.card.exp_month)

card_exp_year = str(resource.card.exp_year)

pass

payment_data = resource.metadata['customer_id']

pass

You may now extract the card ID from the object in the IPN. This is what you will use to initiate future transactions. We recommend that you also document the card’s expiration date in order to verify that the card is still valid before attempting future payments.

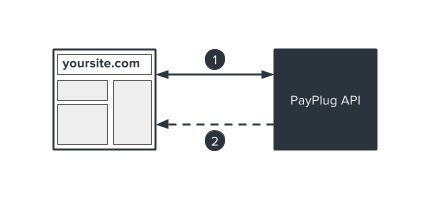

Payments using a card ID

- Create the payment using

payment_method and the previously saved card ID.

- PayPlug sends you a confirmation via IPN.

Processing a payment using a card ID

Now that you have a card ID, you can initiate new payments without necessarily sending your customer to a payment page:

<?php

$email = 'john.watson@example.net';

$amount = 33;

$customer_id = '42710';

$card_id = 'card_e7133426b8de947b37161dfba1897dd1';

$initiator = 'PAYER';

$payment = \Payplug\Payment::create(array(

'amount' => $amount * 100,

'currency' => 'EUR',

'payment_method' => $card_id,

'initiator' => $initiator,

'billing' => array(

'title' => 'mr',

'first_name' => 'John',

'last_name' => 'Watson',

'email' => $email,

'address1' => '221B Baker Street',

'postcode' => 'NW16XE',

'city' => 'London',

'country' => 'GB',

'language' => 'en'

),

'shipping' => array(

'title' => 'mr',

'first_name' => 'John',

'last_name' => 'Watson',

'email' => $email,

'address1' => '221B Baker Street',

'postcode' => 'NW16XE',

'city' => 'London',

'country' => 'GB',

'language' => 'en',

'delivery_type' => 'BILLING'

),

'notification_url' => 'https://example.net/notifications?id='.$customer_id,

'metadata' => array(

'customer_id' => $customer_id

)

));

payment_data = {

'amount': 1000,

'currency': 'EUR',

'payment_method': 'card_e7133426b8de947b37161dfba1897dd1',

'customer': {

'email': 'john.watson@example.net'

},

'notification_url': 'https://example.net/notifications?id=42710',

'metadata': {

'customer_id': 42710,

},

}

payment = payplug.Payment.create(**payment_data)

Once the payment is created, you have to handle the response as explained in the next page.

Payment processing

The payment object holds many fields that you’ll need to process the payment, especially:

{

"id": "pay_5iHMDxy4ABR4YBVW4UscIn",

"amount": 1000,

"is_paid": true,

"authorization": null,

"failure": null,

"hosted_payment": {

"payment_url": "https://secure.payplug.com/pay/5iHMDxy4ABR4YBVW4UscIn",

"return_url": "https://example.net/success?id=42",

"cancel_url": "https://example.net/cancel?id=42",

"paid_at": 1434010827,

"sent_by": null

},

[...]

}

Then you have to handle the response with this logic and in the following order:

- if

is_paid is true, you can consider the payment as being fully paid,

- if both fields

authorization and authorized_at are present and filled, the authorization was successful,

- if you got a

failure, well you got a failed payment,

- otherwise you’ll have a

hosted_payment.payment_url where the payer has to be redirected to complete the payment.

Your customer will receive a confirmation email after each new transaction.

Advantages

The ‘save card’ feature makes the following payment options possible:

1-click ordering

Customers can pay securely without typing in their card details for every purchase.

Recurring payments

Customers can subscribe to services on your site using recurring payments.

Instalments

Customers can pay in three or four interest-free instalments (within a maximum 90-day period).

Please note that recurring payments and instalments are not automated; you will need to manage the payment schedules internally.